Last year, deeptech investment totalled $79bn worldwide, and while that represents a drop of 26% from 2022, in the first quarter of this year deeptech and climate tech companies were responsible for 27% and 26% respectively of the total funds raised so far.

Recent research conducted by BCG indicates that 20% of all venture capital funding goes to deeptech companies, up from 10% just 10 years ago. The potential for market disruption across many different industries is huge, however funding progression works differently, and the development time often lags behind shallow tech. Driven by a desire to tackle societal and environmental challenges, the result is many organisations that are developing tangible products or services, as opposed to pure software (AI applications notwithstanding). This type of development presents challenges for investors, and with a renewed focus on profitability and a shifting exit landscape, it’s not surprising that the appetite for risk in this area remains subdued.

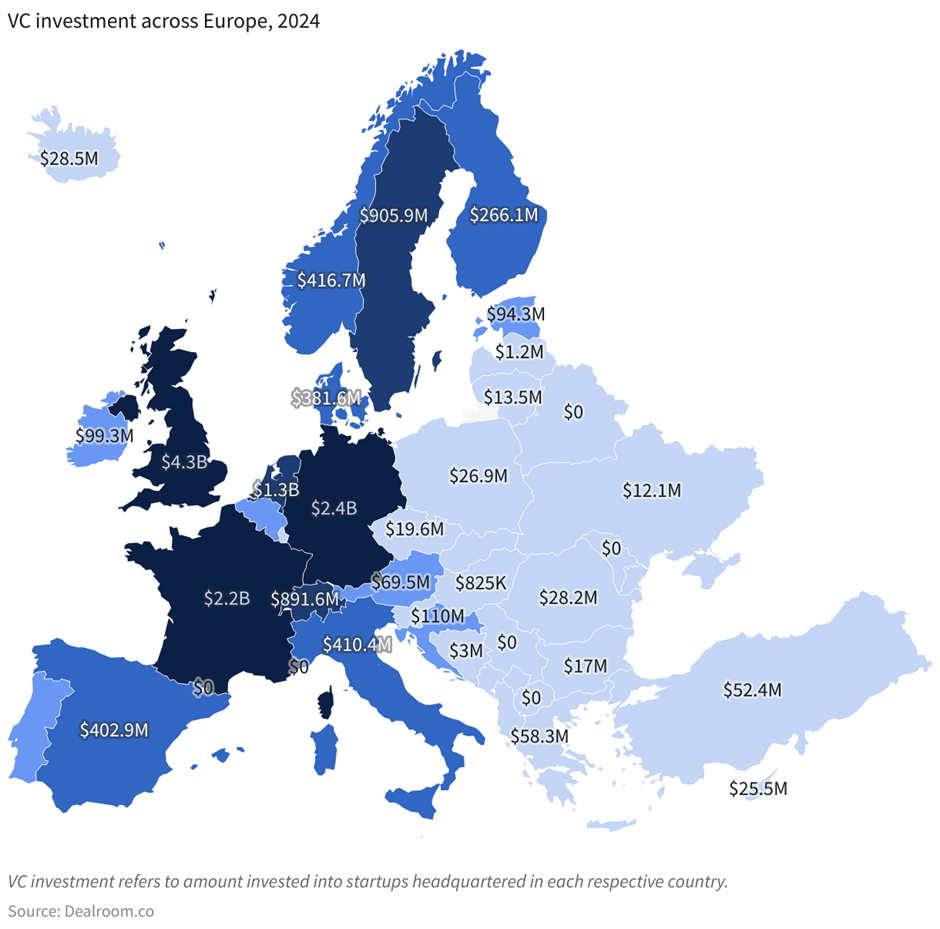

The European landscape is encouraging, with the UK, Germany, France and the Netherlands all leading the way in terms of Q1 VC investments this year, with funding coming from a variety of sources. In March this year, the European Innovation Council (EIC) published its impact report for 2023 and announced the total portfolio value of the companies it supports reached nearly €70bn at the end of 2023, an increase of close to €20bn in just 12 months. Set up as a €10bn programme of the European Union to “identify, support and scale up breakthrough technologies and deeptech start-ups”; in 2023 it made over 100 strategic investments, worth €1.2bn, in deeptech companies. The work programme for 2024 provides funding opportunities dedicated to SMEs and start-ups to develop and scale innovations in critical fields (E.g. AI, space, materials, semiconductors and quantum technologies) – much needed encouragement from European policymakers. In particular, €420m is earmarked for novel technologies and organisations tackling challenges that directly support the European Green Deal, REPowerEU, the Chips Act, future AI Act, Net Zero Industry and other EU policies, including the New European Innovation Agenda.

In Asia, this year, according to KPMG, China has secured eight of the ten largest VC deals in the region, with AI and ‘new energy’ as the most attractive investment sectors. Singapore has emerged as something of a leader in the region with 86% of all deeptech deals in South East Asia from 2020 to mid-2023 originating there. Japan and Korea invest less in deep tech than other OECD countries, but this could be changing. According to a report produced by Korea’s Ministry of SMEs and Startups (MSS), the investment proportion for the top ten deeptech startup sectors increased from 31% at the end of 2023 to 40% in Q1 2024. Japan and Korea have also recently launched a joint initiative to boost their startup ecosystems, establishing a Korea-Japan Joint Fund with $100m. India, home to the world’s third largest startup ecosystem, has seen deeptech funding increase every year for the past three years, culminating in $496m raised in 2023.

The US was still the single largest market for deeptech investment in 2023, attracting 49% of global funding. Despite the worldwide drop overall, certain technologies were more successful last year: advanced materials, nanotechnology, quantum computing and biotech. Distribution from VC funds dropped 84% from 2021 to 2023, growing dry powder inventory to approximately $330bn at the end of Q1.

Finding the right leadership talent and getting the right teams in place will be critical once investment activity increases. If you’d like to understand how you can prepare your organisation for growth and understand what the market for talent looks like, please get in touch.

Leave a comment